Instrumental Variables

Last updated on Mar 9, 2022

# Remove warnings

import warnings

warnings.filterwarnings('ignore')

# Import everything

import pandas as pd

import numpy as np

import seaborn as sns

import statsmodels.api as sm

from numpy.linalg import inv

from statsmodels.iolib.summary2 import summary_col

from linearmodels.iv import IV2SLS

# Import matplotlib for graphs

import matplotlib.pyplot as plt

from mpl_toolkits.mplot3d import axes3d

# Set global parameters

%matplotlib inline

plt.style.use('seaborn-white')

plt.rcParams['lines.linewidth'] = 3

plt.rcParams['figure.figsize'] = (10,6)

plt.rcParams['figure.titlesize'] = 20

plt.rcParams['axes.titlesize'] = 18

plt.rcParams['axes.labelsize'] = 14

plt.rcParams['legend.fontsize'] = 14

2.1 Simple Linear Regression

In Acemoglu, Johnson, Robinson (2002), “The Colonial Origins of Comparative Development” the authors wish to determine whether or not differences in institutions can help to explain observed economic outcomes.

How do we measure institutional differences and economic outcomes?

In this paper,

- economic outcomes are proxied by log GDP per capita in 1995, adjusted for exchange rates.

- institutional differences are proxied by an index of protection against expropriation on average over 1985-95, constructed by the Political Risk Services Group.

These variables and other data used in the paper are available for download on Daron Acemoglu’s webpage.

The original dataset in in Stata .dta format but has been converted to .csv.

First, let’s load the data and have a look at it.

# Load Acemoglu Johnson Robinson Dataset

df = pd.read_csv('data/AJR02.csv',index_col=0)

df.head()

| GDP | Exprop | Mort | Latitude | Neo | Africa | Asia | Namer | Samer | logMort | Latitude2 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 8.39 | 6.50 | 78.20 | 0.3111 | 0 | 1 | 0 | 0 | 0 | 4.359270 | 0.096783 |

| 2 | 7.77 | 5.36 | 280.00 | 0.1367 | 0 | 1 | 0 | 0 | 0 | 5.634790 | 0.018687 |

| 3 | 9.13 | 6.39 | 68.90 | 0.3778 | 0 | 0 | 0 | 0 | 1 | 4.232656 | 0.142733 |

| 4 | 9.90 | 9.32 | 8.55 | 0.3000 | 1 | 0 | 0 | 0 | 0 | 2.145931 | 0.090000 |

| 5 | 9.29 | 7.50 | 85.00 | 0.2683 | 0 | 0 | 0 | 1 | 0 | 4.442651 | 0.071985 |

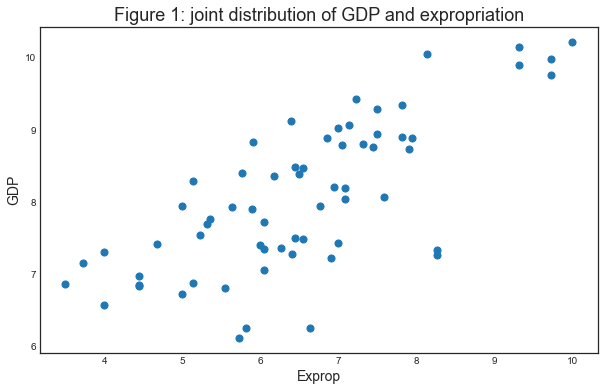

Let’s use a scatterplot to see whether any obvious relationship exists between GDP per capita and the protection against expropriation.

# Plot relationship between GDP and expropriation rate

fig, ax = plt.subplots(1,1)

ax.set_title('Figure 1: joint distribution of GDP and expropriation')

df.plot(x='Exprop', y='GDP', kind='scatter', s=50, ax=ax);

The plot shows a fairly strong positive relationship between protection against expropriation and log GDP per capita.

Specifically, if higher protection against expropriation is a measure of institutional quality, then better institutions appear to be positively correlated with better economic outcomes (higher GDP per capita).

Given the plot, choosing a linear model to describe this relationship seems like a reasonable assumption.

We can write our model as

$$ {GDP}_i = \beta_0 + \beta_1 {Exprop}_i + \varepsilon_i $$

where:

- $ \beta_0 $ is the intercept of the linear trend line on the y-axis

- $ \beta_1 $ is the slope of the linear trend line, representing the marginal effect of protection against risk on log GDP per capita

- $ \varepsilon_i $ is a random error term (deviations of observations from the linear trend due to factors not included in the model)

The most common technique to estimate the parameters ($ \beta $’s) of the linear model is Ordinary Least Squares (OLS).

As the name implies, an OLS model is solved by finding the parameters that minimize the sum of squared residuals, i.e.

$$ \underset{\hat{\beta}}{\min} \sum^N_{i=1}{\hat{u}^2_i} $$

where $ \hat{u}_i $ is the difference between the observation and the predicted value of the dependent variable.

To estimate the constant term $ \beta_0 $, we need to add a column of 1’s to our dataset (consider the equation if $ \beta_0 $ was replaced with $ \beta_0 x_i $ and $ x_i = 1 $)

Now we can construct our model in statsmodels using the OLS function.

We will use pandas dataframes with statsmodels, however standard arrays can also be used as arguments

# Regress GDP on Expropriation Rate

reg1 = sm.OLS.from_formula('GDP ~ Exprop', df)

type(reg1)

statsmodels.regression.linear_model.OLS

So far we have simply constructed our model.

We need to use .fit() to obtain parameter estimates

$ \hat{\beta}_0 $ and $ \hat{\beta}_1 $

# Fit regression

results = reg1.fit()

type(results)

statsmodels.regression.linear_model.RegressionResultsWrapper

We now have the fitted regression model stored in results.

To view the OLS regression results, we can call the .summary()

method.

Note that an observation was mistakenly dropped from the results in the original paper (see the note located in maketable2.do from Acemoglu’s webpage), and thus the coefficients differ slightly.

results.summary()

| Dep. Variable: | GDP | R-squared: | 0.540 |

|---|---|---|---|

| Model: | OLS | Adj. R-squared: | 0.532 |

| Method: | Least Squares | F-statistic: | 72.71 |

| Date: | Mon, 03 Jan 2022 | Prob (F-statistic): | 4.84e-12 |

| Time: | 18:31:09 | Log-Likelihood: | -68.214 |

| No. Observations: | 64 | AIC: | 140.4 |

| Df Residuals: | 62 | BIC: | 144.7 |

| Df Model: | 1 | ||

| Covariance Type: | nonrobust |

| coef | std err | t | P>|t| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| Intercept | 4.6609 | 0.409 | 11.402 | 0.000 | 3.844 | 5.478 |

| Exprop | 0.5220 | 0.061 | 8.527 | 0.000 | 0.400 | 0.644 |

| Omnibus: | 7.134 | Durbin-Watson: | 2.081 |

|---|---|---|---|

| Prob(Omnibus): | 0.028 | Jarque-Bera (JB): | 6.698 |

| Skew: | -0.784 | Prob(JB): | 0.0351 |

| Kurtosis: | 3.234 | Cond. No. | 31.2 |

Warnings:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

From our results, we see that

- The intercept $ \hat{\beta}_0 = 4.63 $.

- The slope $ \hat{\beta}_1 = 0.53 $.

- The positive $ \hat{\beta}_1 $ parameter estimate implies that. institutional quality has a positive effect on economic outcomes, as we saw in the figure.

- The p-value of 0.000 for $ \hat{\beta}_1 $ implies that the effect of institutions on GDP is statistically significant (using p < 0.05 as a rejection rule).

- The R-squared value of 0.611 indicates that around 61% of variation in log GDP per capita is explained by protection against expropriation.

Using our parameter estimates, we can now write our estimated relationship as

$$ \widehat{GDP}_i = 4.63 + 0.53 \ {Exprop}_i $$

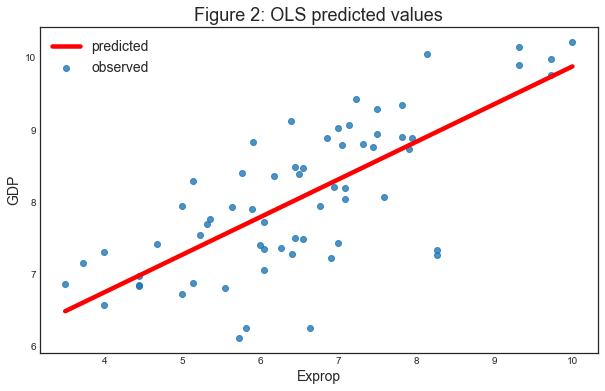

This equation describes the line that best fits our data, as shown in Figure 2.

We can use this equation to predict the level of log GDP per capita for a value of the index of expropriation protection.

For example, for a country with an index value of 6.51 (the average for the dataset), we find that their predicted level of log GDP per capita in 1995 is 8.09.

mean_expr = np.mean(df['Exprop'])

mean_expr

6.5160937500000005

predicted_logpdp95 = results.params[0] + results.params[1] * mean_expr

predicted_logpdp95

8.062499999999995

An easier (and more accurate) way to obtain this result is to use

.predict() and set $ constant = 1 $ and

$ {Exprop}_i = mean_expr $

results.predict(exog=[1, mean_expr])

We can obtain an array of predicted $ {GDP}_i $ for every value

of $ {Exprop}_i $ in our dataset by calling .predict() on our

results.

Plotting the predicted values against $ {Exprop}_i $ shows that the predicted values lie along the linear line that we fitted above.

The observed values of $ {GDP}_i $ are also plotted for comparison purposes

# Make first new figure

def make_new_fig_2():

# Init figure

fig, ax = plt.subplots(1,1)

ax.set_title('Figure 2: OLS predicted values')

# Drop missing observations from whole sample

df_plot = df.dropna(subset=['GDP', 'Exprop'])

sns.regplot(x=df_plot['Exprop'], y=df_plot['GDP'], ax=ax, order=1, ci=None, line_kws={'color':'r'})

ax.legend(['predicted', 'observed'])

ax.set_xlabel('Exprop')

ax.set_ylabel('GDP')

plt.show()

make_new_fig_2()

ERROR! Session/line number was not unique in database. History logging moved to new session 305

2.2 Extending the Linear Regression Model

So far we have only accounted for institutions affecting economic performance - almost certainly there are numerous other factors affecting GDP that are not included in our model.

Leaving out variables that affect $ GDP_i $ will result in omitted variable bias, yielding biased and inconsistent parameter estimates.

We can extend our bivariate regression model to a multivariate regression model by adding in other factors that may affect $ GDP_i $.

[AJR01] consider other factors such as:

- the effect of climate on economic outcomes; latitude is used to proxy this

- differences that affect both economic performance and institutions, eg. cultural, historical, etc.; controlled for with the use of continent dummies

Let’s estimate some of the extended models considered in the paper

(Table 2) using data from maketable2.dta

# Add constant term to dataset

df['const'] = 1

# Create lists of variables to be used in each regression

X1 = df[['const', 'Exprop']]

X2 = df[['const', 'Exprop', 'Latitude', 'Latitude2']]

X3 = df[['const', 'Exprop', 'Latitude', 'Latitude2', 'Asia', 'Africa', 'Namer', 'Samer']]

# Estimate an OLS regression for each set of variables

reg1 = sm.OLS(df['GDP'], X1, missing='drop').fit()

reg2 = sm.OLS(df['GDP'], X2, missing='drop').fit()

reg3 = sm.OLS(df['GDP'], X3, missing='drop').fit()

Now that we have fitted our model, we will use summary_col to

display the results in a single table (model numbers correspond to those

in the paper)

info_dict={'No. observations' : lambda x: f"{int(x.nobs):d}"}

results_table = summary_col(results=[reg1,reg2,reg3],

float_format='%0.2f',

stars = True,

model_names=['Model 1','Model 2','Model 3'],

info_dict=info_dict,

regressor_order=['const','Exprop','Latitude','Latitude2'])

results_table

| Model 1 | Model 2 | Model 3 | |

|---|---|---|---|

| const | 4.66*** | 4.55*** | 5.95*** |

| (0.41) | (0.45) | (0.68) | |

| Exprop | 0.52*** | 0.49*** | 0.40*** |

| (0.06) | (0.07) | (0.06) | |

| Latitude | 2.16 | 0.42 | |

| (1.68) | (1.47) | ||

| Latitude2 | -2.12 | 0.44 | |

| (2.86) | (2.48) | ||

| Africa | -1.06** | ||

| (0.41) | |||

| Asia | -0.74* | ||

| (0.42) | |||

| Namer | -0.17 | ||

| (0.40) | |||

| Samer | -0.12 | ||

| (0.42) | |||

| No. observations | 64 | 64 | 64 |

2.3 Endogeneity

As [AJR01] discuss, the OLS models likely suffer from endogeneity issues, resulting in biased and inconsistent model estimates.

Namely, there is likely a two-way relationship between institutions an economic outcomes:

- richer countries may be able to afford or prefer better institutions

- variables that affect income may also be correlated with institutional differences

- the construction of the index may be biased; analysts may be biased towards seeing countries with higher income having better institutions

To deal with endogeneity, we can use two-stage least squares (2SLS) regression, which is an extension of OLS regression.

This method requires replacing the endogenous variable $ {Exprop}_i $ with a variable that is:

- correlated with $ {Exprop}_i $

- not correlated with the error term (ie. it should not directly affect the dependent variable, otherwise it would be correlated with $ u_i $ due to omitted variable bias)

We can write our model as

$$ {GDP}_i = \beta_0 + \beta_1 {Exprop}_i + \varepsilon_i \ {Exprop}_i = \delta_0 + \delta_1 {logMort}_i + v_i $$

The new set of regressors logMort is called an instrument, which aims to remove endogeneity in our proxy of institutional differences.

The main contribution of [AJR01] is the use of settler mortality rates to instrument for institutional differences.

They hypothesize that higher mortality rates of colonizers led to the establishment of institutions that were more extractive in nature (less protection against expropriation), and these institutions still persist today.

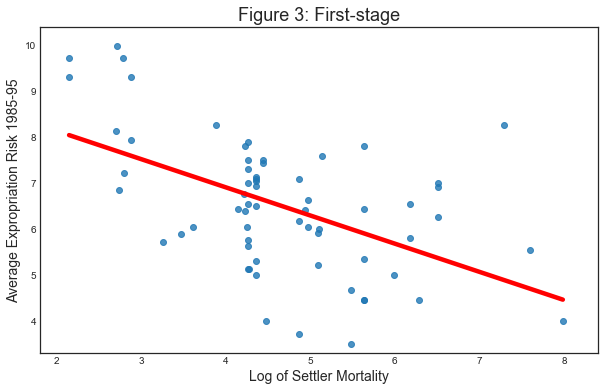

Using a scatterplot (Figure 3 in [AJR01]), we can see protection against expropriation is negatively correlated with settler mortality rates, coinciding with the authors’ hypothesis and satisfying the first condition of a valid instrument.

# Dropping NA's is required to use numpy's polyfit

df2 = df.dropna(subset=['logMort', 'Exprop'])

X = df2['logMort']

y = df2['Exprop']

# Make new figure 2

def make_new_figure_2():

# Init figure

fig, ax = plt.subplots(1,1)

ax.set_title('Figure 3: First-stage')

# Fit a linear trend line

sns.regplot(x=X, y=y, ax=ax, order=1, scatter=True, ci=None, line_kws={"color": "r"})

ax.set_xlim([1.8,8.4])

ax.set_ylim([3.3,10.4])

ax.set_xlabel('Log of Settler Mortality')

ax.set_ylabel('Average Expropriation Risk 1985-95');

make_new_figure_2()

The second condition may not be satisfied if settler mortality rates in the 17th to 19th centuries have a direct effect on current GDP (in addition to their indirect effect through institutions).

For example, settler mortality rates may be related to the current disease environment in a country, which could affect current economic performance.

[AJR01] argue this is unlikely because:

- The majority of settler deaths were due to malaria and yellow fever and had a limited effect on local people.

- The disease burden on local people in Africa or India, for example, did not appear to be higher than average, supported by relatively high population densities in these areas before colonization.

As we appear to have a valid instrument, we can use 2SLS regression to obtain consistent and unbiased parameter estimates.

First stage

The first stage involves regressing the endogenous variable ($ {Exprop}_i $) on the instrument.

The instrument is the set of all exogenous variables in our model (and not just the variable we have replaced).

Using model 1 as an example, our instrument is simply a constant and settler mortality rates $ {logMort}_i $.

Therefore, we will estimate the first-stage regression as

$$ {Exprop}_i = \delta_0 + \delta_1 {logMort}_i + v_i $$

# Add a constant variable

df['const'] = 1

# Fit the first stage regression and print summary

results_fs = sm.OLS(df['Exprop'],

df.loc[:,['const', 'logMort']],

missing='drop').fit()

results_fs.summary()

| Dep. Variable: | Exprop | R-squared: | 0.274 |

|---|---|---|---|

| Model: | OLS | Adj. R-squared: | 0.262 |

| Method: | Least Squares | F-statistic: | 23.34 |

| Date: | Mon, 03 Jan 2022 | Prob (F-statistic): | 9.27e-06 |

| Time: | 18:31:10 | Log-Likelihood: | -104.69 |

| No. Observations: | 64 | AIC: | 213.4 |

| Df Residuals: | 62 | BIC: | 217.7 |

| Df Model: | 1 | ||

| Covariance Type: | nonrobust |

| coef | std err | t | P>|t| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| const | 9.3659 | 0.611 | 15.339 | 0.000 | 8.145 | 10.586 |

| logMort | -0.6133 | 0.127 | -4.831 | 0.000 | -0.867 | -0.360 |

| Omnibus: | 0.047 | Durbin-Watson: | 1.592 |

|---|---|---|---|

| Prob(Omnibus): | 0.977 | Jarque-Bera (JB): | 0.154 |

| Skew: | 0.060 | Prob(JB): | 0.926 |

| Kurtosis: | 2.792 | Cond. No. | 19.4 |

Warnings:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

We need to retrieve the predicted values of $ {Exprop}_i $ using

.predict().

We then replace the endogenous variable $ {Exprop}_i $ with the predicted values $ \widehat{Exprop}_i $ in the original linear model.

Our second stage regression is thus

$$ {GDP}_i = \beta_0 + \beta_1 \widehat{Exprop}_i + u_i $$

Second stage

# Second stage

df['predicted_Exprop'] = results_fs.predict()

results_ss = sm.OLS.from_formula('GDP ~ predicted_Exprop', df).fit()

# Print

results_ss.summary()

| Dep. Variable: | GDP | R-squared: | 0.462 |

|---|---|---|---|

| Model: | OLS | Adj. R-squared: | 0.453 |

| Method: | Least Squares | F-statistic: | 53.24 |

| Date: | Mon, 03 Jan 2022 | Prob (F-statistic): | 6.58e-10 |

| Time: | 18:31:10 | Log-Likelihood: | -73.208 |

| No. Observations: | 64 | AIC: | 150.4 |

| Df Residuals: | 62 | BIC: | 154.7 |

| Df Model: | 1 | ||

| Covariance Type: | nonrobust |

| coef | std err | t | P>|t| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| Intercept | 2.0448 | 0.830 | 2.463 | 0.017 | 0.385 | 3.705 |

| predicted_Exprop | 0.9235 | 0.127 | 7.297 | 0.000 | 0.671 | 1.177 |

| Omnibus: | 10.463 | Durbin-Watson: | 2.052 |

|---|---|---|---|

| Prob(Omnibus): | 0.005 | Jarque-Bera (JB): | 10.693 |

| Skew: | -0.806 | Prob(JB): | 0.00476 |

| Kurtosis: | 4.188 | Cond. No. | 57.8 |

Warnings:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

The second-stage regression results give us an unbiased and consistent estimate of the effect of institutions on economic outcomes.

The result suggests a stronger positive relationship than what the OLS results indicated.

Note that while our parameter estimates are correct, our standard errors are not and for this reason, computing 2SLS ‘manually’ (in stages with OLS) is not recommended.

We can correctly estimate a 2SLS regression in one step using the

linearmodels package, an extension of statsmodels

Note that when using IV2SLS, the exogenous and instrument variables

are split up in the function arguments (whereas before the instrument

included exogenous variables)

# IV regression

iv = IV2SLS(dependent=df['GDP'],

exog=df['const'],

endog=df['Exprop'],

instruments=df['logMort']).fit()

# Print

iv.summary

| Dep. Variable: | GDP | R-squared: | 0.2205 |

|---|---|---|---|

| Estimator: | IV-2SLS | Adj. R-squared: | 0.2079 |

| No. Observations: | 64 | F-statistic: | 29.811 |

| Date: | Mon, Jan 03 2022 | P-value (F-stat) | 0.0000 |

| Time: | 18:31:10 | Distribution: | chi2(1) |

| Cov. Estimator: | robust | ||

| Parameter | Std. Err. | T-stat | P-value | Lower CI | Upper CI | |

|---|---|---|---|---|---|---|

| const | 2.0448 | 1.1273 | 1.8139 | 0.0697 | -0.1647 | 4.2542 |

| Exprop | 0.9235 | 0.1691 | 5.4599 | 0.0000 | 0.5920 | 1.2550 |

Endogenous: Exprop

Instruments: logMort

Robust Covariance (Heteroskedastic)

Debiased: False

Given that we now have consistent and unbiased estimates, we can infer from the model we have estimated that institutional differences (stemming from institutions set up during colonization) can help to explain differences in income levels across countries today.

[AJR01] use a marginal effect of 0.94 to calculate that the difference in the index between Chile and Nigeria (ie. institutional quality) implies up to a 7-fold difference in income, emphasizing the significance of institutions in economic development.

2.4 Matrix Algebra

The OLS parameter $ \beta $ can also be estimated using matrix

algebra and numpy.

The linear equation we want to estimate is (written in matrix form)

$$ y = X\beta + \varepsilon $$

# Init

X = df[['const', 'Exprop']].values

Z = df[['const', 'logMort']].values

y = df['GDP'].values

To solve for the unknown parameter $ \beta $, we want to minimize the sum of squared residuals

$$ \underset{\hat{\beta}}{\min} \ \hat{\varepsilon}’\hat{\varepsilon} $$

Rearranging the first equation and substituting into the second equation, we can write

$$ \underset{\hat{\beta}}{\min} \ (Y - X\hat{\beta})’ (Y - X\hat{\beta}) $$

Solving this optimization problem gives the solution for the $ \hat{\beta} $ coefficients

$$ \hat{\beta} = (X’X)^{-1}X’y $$

# Compute beta OLS

beta_OLS = inv(X.T @ X) @ X.T @ y

print(beta_OLS)

[4.66087966 0.52203367]

As we as see above, the OLS coefficient might suffer from endogeneity bias. We can solve the issue by instrumenting the predicted average expropriation rate with the average settler mortality.

If we define settler mortality as $Z$, our full model is

$$ y = X\beta + \varepsilon \ X = Z\gamma + \mu $$

Where we refer to the second equation as second stage and to the first equation as the reduced form equation. In our case, since the number of endogenous varaibles is equal to the number of insturments, there are two equivalent estimators that do not suffer from endogeneity bias: 2SLS and IV.

IV, the one stage estimator

$$ \hat \beta_{IV} = (Z’X)^{-1} Z’ y $$

# Compute beta IV

beta_IV = inv(Z.T @ X) @ Z.T @ y

print(beta_IV)

[2.0447613 0.92351936]

One of the hypothesis behind the IV estimator is the relevance of the instrument, i.e. we have a strong predictor in the first stage. This is the only hypothesis that we can empirically assess by checking the significance of the first stage coefficient.

$$ \hat \gamma = (Z’ Z)^{-1} Z’X \ \hat Var (\hat \gamma) = \sigma_u^2 (Z’ Z)^{-1} $$

where

$$ u = X - Z \hat \gamma $$

# Estimate first stage coefficient

gamma_hat = (inv(Z.T @ Z) @ Z.T @ X)

print(gamma_hat[1,1])

-0.613289272386864

# Compute variance of the estimator

u = X - Z @ gamma_hat

var_gamma_hat = np.var(u) * inv(Z.T @ Z)

# Compute standard errors

std_gamma_hat = var_gamma_hat[1,1]**.5

print(std_gamma_hat)

0.08834733362858548

# Compute 95% confidence interval

CI = [gamma_hat[1,1] - 1.96*std_gamma_hat, gamma_hat[1,1] + 1.96*std_gamma_hat]

print(CI)

[-0.7864500462988916, -0.4401284984748365]

The first stage coefficient is negative and significant, i.e. settler mortality is negatively correlated with the expropriation rate.

How does it work when we have more instruments than endogenous variables? Two-State Least Squares.

- Regress $X$ on $Z$ and obtain $\hat X$: $$ \hat X = Z (Z’ Z)^{-1} Z’X $$

- Regress $Y$ on $\hat X$ and obtain $\hat \beta_{2SLS}$ $$ \hat \beta_{2SLS} = (\hat X’ \hat X)^{-1} \hat X’ y $$

In our case, just for the sake of exposition, let’s generate a second instrument: the settler mortality squared, logMort_2 = logMort^2.

df['logMort_2'] = df['logMort']**2

# Define Z

Z1 = df[['const', 'logMort', 'logMort_2']].values

# Compute beta 2SLS in two steps

X_hat = Z1 @ inv(Z1.T @ Z1) @ Z1.T @ X

beta_2SLS = inv(X_hat.T @ X_hat) @ X_hat.T @ y

print(beta_2SLS)

[3.08817432 0.76339075]

The 2SLS estimator does not have to be actually estimated in two stages. Combining the two formulas above, we get

$$ \hat{\beta} _ {2SLS} = \Big( X’Z (Z’Z)^{-1} Z’X \Big)^{-1} \Big( X’Z (Z’Z)^{-1} Z’y \Big) $$

which can be computed in one step.

# Compute beta 2SLS in one step

beta_2SLS = inv(X_hat.T @ Z1 @ inv(Z1.T @ Z1) @ Z1.T @ X_hat) @ X_hat.T @ Z1 @ inv(Z1.T @ Z1) @ Z1.T @ y

print(beta_2SLS)

[3.08817432 0.76339075]