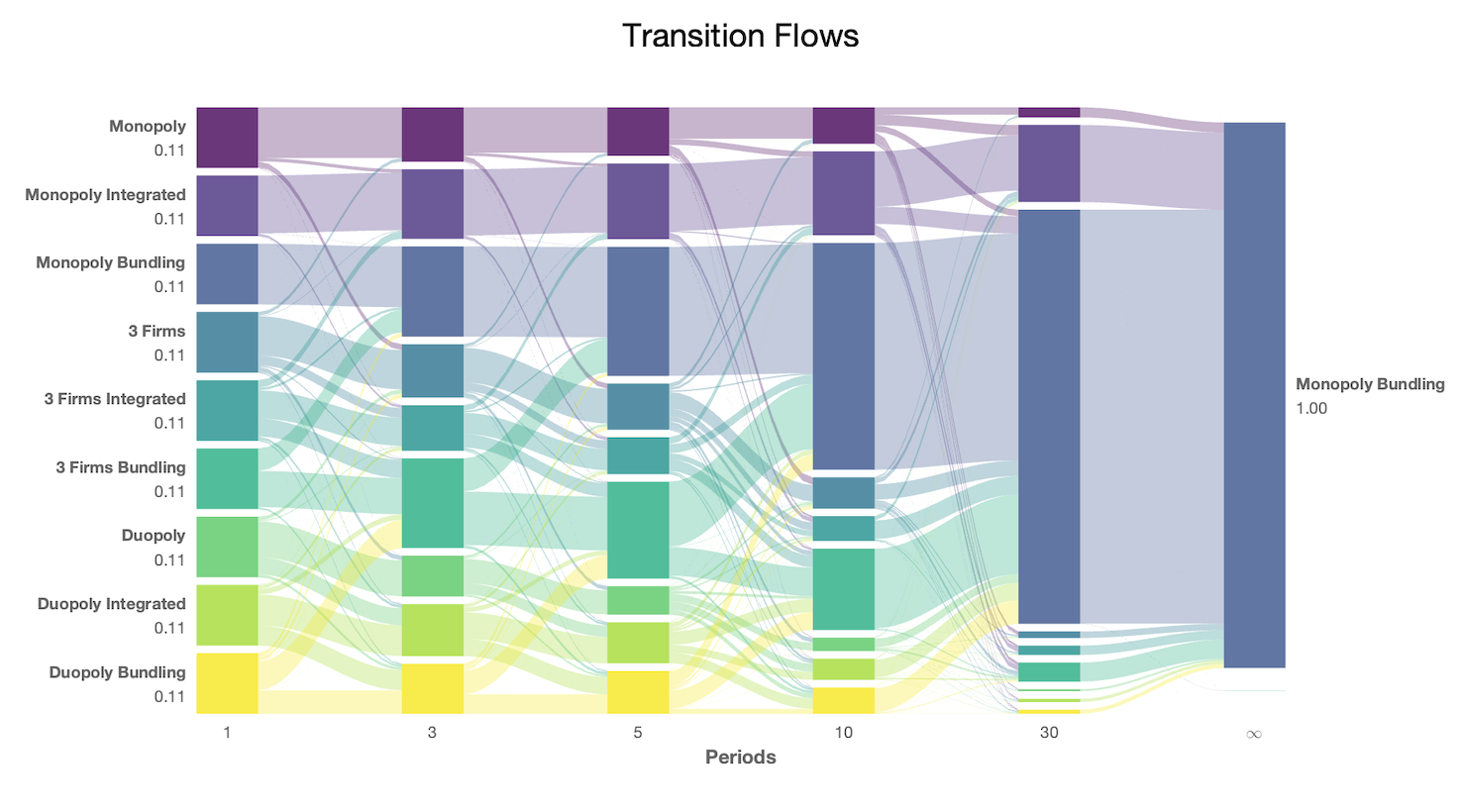

Equilibrum Market Transitions

Equilibrum Market Transitions

In recent merger cases across complementary markets, antitrust authorities have expressed foreclosure concerns. In particular, the presence of scale economies in one market might propagate to the complementary market, ultimately leading to the monopolization of both. In this paper, we investigate the interplay between two foreclosure practices: exclusionary bundling and predatory pricing in the setting of complementary markets with economies of scale. We show that the two practices are complementary when markets display economies of scale, exclusionary bundling is more likely and, when bundling is allowed, predatory pricing is more likely. We show that this outcome is due to exit-inducing behavior of dominant firms: shutting down predatory incentives restores competition in both markets. We investigate different policies: banning mergers between market leaders, allowing product bundling only when more than one firm is integrated and able to offer the bundle, and lastly knowledge sharing across firms in order to limit the economies of scale. All policies are effective, each for a different reason.